What is cryptocurrency?

Chances are, every time you’ve read about cryptocurrency, you’ve come across words like ‘digital gold’ or ‘a peer-to-peer system’ or ‘a decentralised network’. They’re a part of every introduction to digital currency and have many underlying details to them.

In its fundamental essence, cryptocurrency refers to all the encrypted decentralised digital money used for trading worldwide. To break it down, it’s digital because it only exists in digital form, and it’s decentralised because it has no central system for governance or any issuing body. Through cryptography, this digital token system is secure from duplication and acts as a currency.

Bitcoin, the first fully established cryptocurrency created by pseudonymous developer Satoshi Nakamoto, came into existence in 2009. It was posted to a mailing list discussion on cryptography, and consequently, the process of mining and valuing began soon after. Its creator originally described the need for “an electronic payment system based on cryptographic proof instead of trust.”

The technology behind it—Blockchain

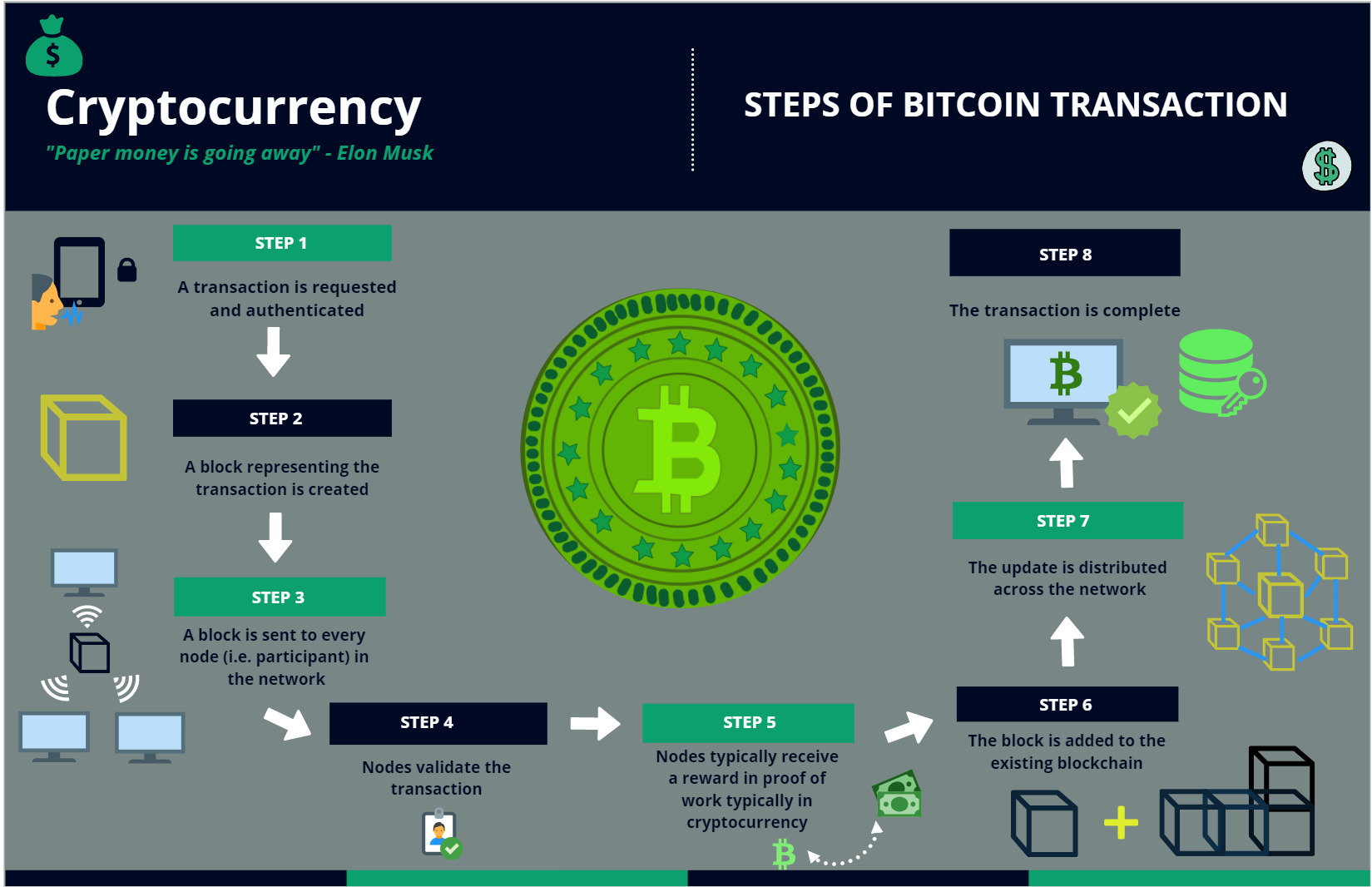

Blockchain is a “decentralised” digital ledger of duplicated transactions and distributed to each of the computers present in that blockchain.

Each “block” in the chain contains several transactions. Every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s block (also called ledger). This means that if one block is tampered with by a hacker, it will be immediately apparent. Ergo, if hackers want to corrupt a blockchain system, they would have to change every block in the chain, i.e. across all the distributed versions of the chain. The methodology by which blockchain records this information makes it nearly impossible to change, hack or cheat the system.

In comparison to the current system, in the case of bitcoin, instead of placing our trust in centralised entities (e.g. banks, governments, and financial institutions), the power and trust are distributed among the network stakeholders (e.g. developers, miners, and consumers). This allows more people to have power since blockchain is built on the concept of “distributed trust.”

Cryptography

In a traditional system, we’ve seen the way banks store our passwords. They rely on technology that allows transactions based on entering the correct password, or passwords. Now, think about how that would work in a system where there is no central authority? There is no bank to maintain a record of passwords, and no particular way of proving ownership of funds.

The solution that cryptocurrency offers? Math.

The word ‘crypto’ in cryptocurrency refers to the security of transactions based on anonymity or pseudo-anonymity. Encryption keys are the most significant aspect of cryptography. They make messages, transactions or other forms of data unreadable unless accessed by the intended recipient.

Cryptocurrency uses addresses and private keys. You could think of an address like a name for your locker, and a private key like a password to access the locker. They’re mathematically linked and connected through a digital signature—i.e., proof of the locker being related to the given password.

Mining:

Say, in the example of bitcoin, mining increases the bitcoin network’s security and fights fraud. Bitcoin “miners” also contribute computing power to every Bitcoin transaction. By contributing their computing power to the bitcoin network for mining, individuals are rewarded with newly minted bitcoins by the community. This also provides a way to distribute new bitcoins equitably.

How are transactions validated?

Intrinsically, each transaction is listed on a public ledger, allowing for transparency and designing a network where you can see a history of every transaction since the beginning. Users are permitted to exchange based on two techniques—proof of work and proof of stake.

Proof of work refers to a method that verifies transactions based on mathematical problems that users or miners solve. The first computer to do so is rewarded with a small amount of cryptocurrency. Proof of stake is a system where you can participate in transactions based on your ownership stake.

How are cryptocurrencies valued?

Cryptocurrency is a volatile asset. It has no fixed value and is decided upon by the supply and demand of tokens. For instance, Bitcoin’s price is not set by anyone in particular. The market sets it—cryptocurrency is traded on multiple exchanges, and a value is determined by averaging out the prices. Say you’re looking to buy and sell bitcoin. This means you’ll have to choose a particular exchange, and look up the average price at the same exchange.

The valuation of cryptocurrency is also connected to a more financial term—liquidity. Essentially, it’s the ability to buy and sell quickly. What makes the crypto market volatile is the number of exchanges taking place in one go, allowing investors to enter and exit trade positions very quickly. Apart from this, media attention due to significant events surrounding the market, and the variation in ownership amongst cryptocurrency giants influence the price at any given time.

Types of cryptocurrencies and a basic introduction to them:

Statistically, at present, there are more than 4000 cryptocurrencies in the market. Most of these have a 0 market cap (popularity in the market). The most popular currencies in the market are fueled by ambitious projects backing them. A few of them are:

Bitcoin (BTC): Bitcoin is the first type of cryptocurrency to have entered the market. There are 18,705,031 in existence, out of which 89% have been mined (to be continued). The limited availability of bitcoin is primarily what causes its price to rise.

Ethereum (ETH): Ethereum is the most common bitcoin alternative. It is a decentralised software platform that enables Decentralised Applications (DApps) to be built and run without any downtime, fraud, control, or interference from a third party. It uses “smart contracts”, which are a collection of code (its functions) and data (its state) that resides at a specific address on the Ethereum blockchain. Ethereum aims to remove the middlemen (like Apple, Google) while publishing an app.

Ripple (XRP): Unlike other cryptocurrencies on this list, Ripple is not blockchain-based. At its core, it’s not meant so much for individual users as it is for larger companies and corporations, moving more significant amounts of money across the globe. In December 2020, Ripple was charged with a lawsuit by the SEC for allegedly conducting an unregistered securities offering.

Dogecoin (DOGE): What started as a “meme coin” in 2013 has attracted a lot of attention in 2021, and it gained over 13,000% in this year. The coin does not have a strong project backing it but we are still seeing a lot of people investing because of the entire meme culture and fear of missing out.

How to invest in digital money?

Many cryptocurrency exchange (trade) platforms allow the users to trade crypto just like they would trade any ordinary stock. These are places where you can buy, sell or hold your cryptocurrency assets. Few exchanges popular in India are:

- CoinDCX

- WazirX

- CoinSwitch Kuber

- ZebPay

- Binance (famous in the US)

Each exchange has its pros and cons. Some factors that should be looked at while choosing a platform:

- Transaction fees

- Ease of use

- Number of coins supported

- Withdrawal/deposit limit

- Withdrawal/deposit methods supported

Should you invest in digital money?

Ideally, as the crypto market is quite volatile, the common thinking is that you should never invest money that you can’t afford to lose. Essentially, you should not invest your entire savings into it, rather invest a part of your savings that wouldn’t affect you financially.

If you are interested in the crypto market, it is always recommended that you do your research about each coin before diving into the action. Read about the projects backing them, feasibility, probability of the price rising, learn about candlesticks in a graph.

What does the future hold for us?

Cryptocurrencies and their applications continue to emerge and develop rapidly. Looking at the current scenario, a very relevant question comes to mind: What is cryptocurrency’s future?

Since digital money advocates a decentralised system, many see a limitless potential surrounding its applications. Visa and Mastercard have begun to support select cryptocurrencies in their purview of payments. As they try to integrate blockchain technology, we are sure to see a plethora of possibilities. Experts say that a more mundane version of the currency—stable coins, can make it to the bigger picture. Stable coins are essentially tethered by an underlying asset to stabilise their price.

As upward price volatility and an increase in users make the headlines, there has been a boost in financial interest, and more people are looking to invest in different coins. That being said, the crypto applications and usage that we see today would’ve been impossible to predict a few years ago. Digital currency continues to expand itself in exciting ways, and even with the existing risks and probabilities, it is likely to see an upsurge over time.

Written by Suhani Kabra, Divyansh Kulshreshtha, Yash Sinha and Aarav Menezes for MTTN

Edited by Avaneesh M for MTTN

Infographic by Thea Clare Anil for MTTN

Featured Image from Pixabay

Leave a Reply

You must be logged in to post a comment.