On February 1st, India’s Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2020-2021 in the Lok Sabha, the lower house of the Parliament. At a time when almost every sector in India has been grappling with a slowdown, all eyes were on the Budget in hopes of reviving the economy. While an opportunist opposition has been calling this slowdown the effect of Modi’s weak economic doctrines, the BJP has dubbed it as a destined ‘cyclical slowdown,’ fueled by the US-China trade war, Brexit, rising oil prices, among other international events. While there is no denying that every five years India’s economy does witness a cyclical slowdown, the brakes on the economy this time around have been way more significant. Rising food prices and falling exports have caused financial outlooks of India by major auditing firms to be in the red zone.

Nirmala Sitharaman presenting the Union Budget for the Fiscal Year 2020-2021 in Lok Sabha. This was the first full Budget of the government after being re-elected to power. (Source: India Today)

Rural India- A Top Priority of This Budget

Three of the four growth engines— private consumption, private investment, and exports—have slowed down significantly. Government expenditure growth has been doing the heavy lifting over the past few quarters as private demand has taken a breather. The key driver of this slowdown was the fall in rural consumption. Take Hindustan Unilever, for example– a company in the Fast-Moving Consumer Goods (FMCG) industry which makes products of domestic use like soaps, shampoos, and biscuits is highly dependent on rural consumption for its sales and earnings. The FMCG industry is supposed to be the most resilient to even the most severe slowdowns. After all, it would be considered dire circumstances if people in rural India stopped buying soaps and shampoos! Now, HUL has registered a significant sales drop in its products in the last few quarters. This highlights the liquidity crisis facing rural India.

Finance Minister Nirmala Sitharaman has chosen to address this crisis by reducing Personal Income Tax rates for almost all individuals.

| Income | New Tax Rates | Old Tax Rates |

| Up to Rs 2.5 lakh | NIL | NIL |

| Rs 2.5 lakh to Rs 5 lakh | 5% | 5% |

| Rs 5 lakh to Rs 7.5 lakh | 10% | 20% |

| Rs 7.5 lakh to Rs 10 lakh | 15% | 20% |

| Rs 10 lakh to Rs 12.5 lakh | 20% | 30% |

| Rs 12.5 lakh to Rs 15 lakh

| 25% | 30% |

| Rs 15 lakh and above | 30% | 30% |

With a steep and significant fall in IT slabs for low-income individuals, the population directly involved with the rural sector is likely to benefit. Everyone, whose annual income falls below 15 lakh per annum, will benefit significantly.

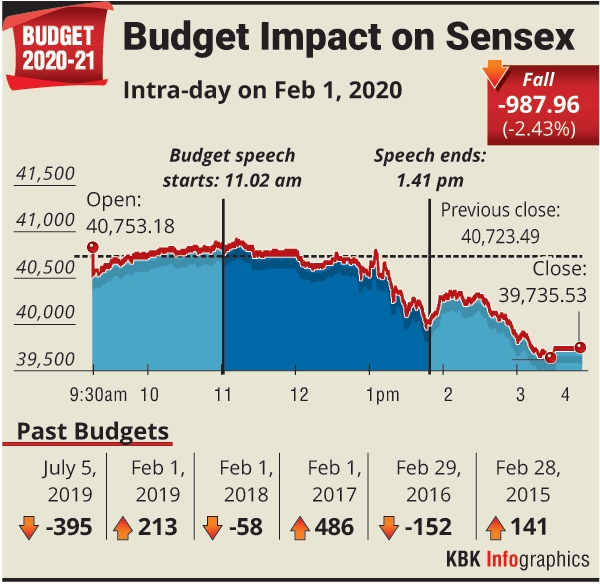

A Slap to Urban India

The large number of high net worth individuals and the ones living in large cities like Mumbai and Delhi have no significant takeaways from Budget 2020. When the Finance Minister reduced corporate taxes by a massive 8% to 22% in September last year, Corporate India was overjoyed. Benchmark stock market indices like the Sensex rose as much as 3,000 points adding lakhs of crores of rupees into the markets. Budget 2020 was entirely anti-climatic to this trailer. As evident in the above table, neither was there any reduction in personal income tax rates, nor was there a widely expected further reduction in the corporate tax rates. All of this resulted in the Sensex falling by more than 900 points on Budget day. While the reversal did occur in the ensuing days, and the Sensex recovered by 1,500 points in the days to come, the Budget has given a tight slap to urban India. This is the same demographic which overwhelmingly voted for the right-wing capitalist BJP in the hope of significant tax cuts and reversal of socialist policies of previous governments. The large allocations to the agricultural sector like increase in fertilizer subsidies and provisions for the upcoming Rabi crop coupled with personal tax cuts for them, with nothing for ‘India Inc,’ has left urban India surprised and disappointed.

SENSEX performance on Budget Day. As is visible, this was one of the worst performances of the market with respect to reactions on previous Budget Days. (Source: KBK Infographics)

The Disinvestment of The Golden Goose- LIC

The Life Insurance Corporation of India has bailed the Indian Government out many times over the years. Still, it may not be able to do so any more after the Initial Public Offering (IPO) proposed by Finance Minister Nirmala Sitharaman in her budget speech. As the Finance Minister said,

“Listing of companies on stock exchanges disciplines the companies and provides access to financial markets and unlocks its value. It allows retail investors to participate in the wealth so created. The Government now proposes to sell a part of its holding in the LIC of India by way of Initial Public Offering.”

-Nirmala Sitharaman, Union Minister of Finance and Corporate Affairs.

If the LIC gets disciplined as promised by the Finance Minister and plays by the rules of the market, politicians will no longer be able to arm-twist the insurance giant to bail out public sector companies as and when needed. As of 2018, it has 23.6 lakh crore invested in the financial markets. But almost 85 of every 100 rupees invested has been in public sector companies and government bonds. This is the result of the LIC being misused by multiple governments over the years. In 2010, the government made LIC buy shares of NMDC, NTPC and REC because other investors weren’t forthcoming. In 2012, it was ONGC. In 2014, BHEL. In 2015 and 2016 it was Coal India and Indian Oil respectively. In 2017 and 2018 the government made LIC buy out nearly three-fourths of GIC and HAL respectively. It also owns a significant stake in companies like MTNL and SAIL.

Air India is up for sale next, and there have been no interested buyers yet. LIC could have bought off Air India and saved the national carrier from embarrassment yet again. But this time, the Modi government has decided to let go of the golden goose itself. This will not allow the government to use LIC to prop up the market by investing millions of dollars whenever the stock markets have tanked. However, if the government does wish to disinvest LIC, it must make the company sellable. This would involve off-loading millions of shares in many companies in the next few months. The bulk off-loading could dent market sentiments severely and drag stocks to the bottom. On the flip side, LIC may get financially healthier, and that is good news for the millions of policyholders in the country.

The Life Insurance Corporation of India will be partly sold to private investors through the IPO route. If done as expected, LIC may become India’s largest company by market capitalization. (Source: businesstoday.in)

More Money Will Pour in From Abroad

As India aims for a $5 trillion economy, the government is optimistic of continuing to attract foreign investment. The government’s liberalized norms along with a significant jump in the ease of doing business ranking are expected to boost further foreign investment in India which should, in turn, give the much-needed impetus to the economy.

In the Union Budget for the fiscal year 2020, the finance minister had indicated that the government would examine suggestions for opening up FDI in the insurance sector in consultation with all stakeholders. Subsequently, the FDI limit in insurance intermediaries was increased from 49% to 100%. It is expected that the government could raise overseas investment limit in Indian insurance companies to 74% under the approval route from the existing 49%.

The increase in FDI limit could pave the way for foreign players who are expected to bring in new technologies, new products and ensure better market penetration. This will also ensure that long-term funds stay invested in India.

Conclusion

Budget for FY21 has been disappointing as it is a lost opportunity to revive growth. While there was optimism when the corporate tax rate was cut, similar reductions in personal income tax would have gone a long way in demand revival in the economy. The FM had all the leeway to go for higher fiscal deficit and create space for more CAPEX and push for major reforms in consumption demand, but either the intent or the political will seems to be missing.

While the social agenda of the government is appreciative with a focus on doubling farmer income, housing for all, water and sanitation, railways and road and, increasing health care benefits under ‘Ayushman Bharat,’ the financial allocations for the same seems inadequate in the Budget.

For a government that had been elected with a strong mandate, it seems to have wasted its majority in this one instance.

Citations: www.businessinsider.com, www.indiabudget.gov.in, Prabhudas Lilladher Private Limited

Written By Sunay Mehta for MTTN.

Edited By Siri Rajanahally

Leave a Reply

You must be logged in to post a comment.